When looking for our home in Cumming, GA our family traveled 75 miles (each way) virtually every weekend for months in hopes of finding our dream home. While on one of our many “scouting trips” to the area we noticed an OPEN HOUSE sign in one of our top choice neighborhoods and decided to stop in for a peek.

When looking for our home in Cumming, GA our family traveled 75 miles (each way) virtually every weekend for months in hopes of finding our dream home. While on one of our many “scouting trips” to the area we noticed an OPEN HOUSE sign in one of our top choice neighborhoods and decided to stop in for a peek.

The front door was open when we arrived so we stepped into the foyer with a loud “Hello” to alert the agent on duty that someone was in the home only to find a woman in baggy sweats and a grungy t-shirt trying to wrangle a couple of screaming kids intent on trouncing us as they ran through the house and out the front door.

My first thought was that we must be there on the wrong day, but no, this was the real estate agent/owner and she was “happy that we had stopped by, but she needed to put her son down for a nap so we should feel free to just walk on through on our own”.

To say that we were shocked was a bit of an understatement. To find out that the home was owned by a licensed and ACTIVE real estate agent almost floored me as she was breaking virtually EVERY open house rule in the book. It was then that it dawned on me that if an agent is confused about open house protocol than perhaps many “regular” homeowner/sellers may be making some of the same mistakes so I decided to write up a quick blog based on this experience in an effort to “stop the madness”!

•1) CLEAN THE HOUSE: Dead bugs in the foyer and filthy, matted carpeting do not set the right tone with a buyer looking for a home in a $400K+ neighborhood. (No matter what the price point, there is no such thing as too clean when your home is on the market.)

•2) NO KIDS: Leave the property to the professionals. Having your family at home during an open house (or any showing, for that matter) distracts potential buyers and makes them uncomfortable. This will only limit their ability to really look at the house as opening closets and cupboards seems very personal when the owner is just over your shoulder.

•3) NO PETS: I love dogs, but many people have allergies and just seeing a pet, or pet paraphernalia, is enough to squash their interest in a property.

•4) NO STRONG SMELLS: Do not cook a big bacon and onion filled breakfast just before an open house (maybe that’s why the front door was open…) People can be put off by strong odors, even non-offensive ones like perfume or room spray.

•5) NEUTRALIZE YOUR PAINT COLORS: The pink and purple “princess room” was adorable, but I don’t have a little girl and it just looked like a great big project to me!

•6) MOVE THE JUNK: If the basement (or attic) is unfinished, move the junk so a buyer can see where things are – this one was supposedly stubbed for a full bath (a make or break item for us), but we couldn’t find the plumbing under all the junk.

•7) MAKE A GREAT FIRST IMPRESSION: If you want buyers walking through the front door your home must first impress them with its curb appeal. Landscaping should be clean and neat; paint should be fresh and yard toys should be put away.

Basically, all I’m saying is DON‘T OVERLOOK THE OBVIOUS when you’re trying to sell. Every minute you spend making your home “show ready” is worthwhile.

I hope that the practical tips and information I provide on my site will empower you with the information you need to take the critical steps necessary when buying or selling a home. If you did not find the information you’re looking for here, please ask me! I am always available to help.

This Cumming GA Real Estate blog is hosted by Gayle Barton of BERKSHIRE HATHAWAY HomeServices Georgia Properties.

I specialize in Real Estate sales in the following Forsyth County, North Fulton County and East Cobb cities: Cumming, Suwanee, Johns Creek, Alpharetta, Duluth, Milton, and Roswell. Other areas are serviced by request.

Gayle Barton South Forsyth Real Estate | Cumming GA Real Estate

Gayle Barton Cumming GA Real Estate | South Forsyth Real Estate

Buyer’s ask me all of the time –

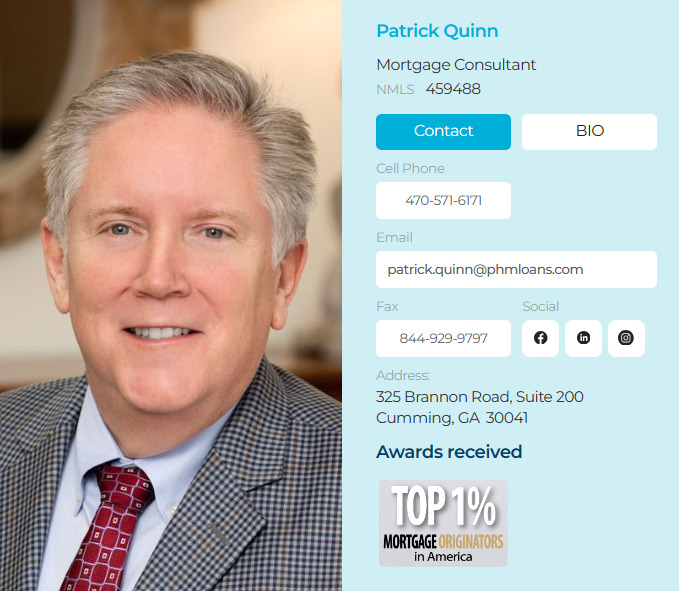

Buyer’s ask me all of the time –  Whether you are buying your first home, or your 10th, home mortgage and financing details can be somewhat overwhelming. And, figuring out what a loan really costs (and what all of those fees are for) can be a daunting task as well.

Whether you are buying your first home, or your 10th, home mortgage and financing details can be somewhat overwhelming. And, figuring out what a loan really costs (and what all of those fees are for) can be a daunting task as well. When I began speaking with a Forsyth County home seller regarding the pricing model for their home, generally, my first step is to complete a

When I began speaking with a Forsyth County home seller regarding the pricing model for their home, generally, my first step is to complete a

My clients needs are my number one priority and putting them first is how I distinguish myself from other agents in my area.

My clients needs are my number one priority and putting them first is how I distinguish myself from other agents in my area.