As most homebuyers know, your FICO score (the credit score created by Fair Isaac Corporation) rules your world!

…did you know that the big three credit services base a large part of your credit scores on the “balance due” to “card limit” ratio??

Your FICO credit score will not just determine if you can get a mortgage, but what interest rate you will pay for it. And, did you know that that little three digit score can also affect the price of your home and auto insurance? It can even keep you from getting the job you want!

Your FICO Score is calculated by a mathematical algorithm that evaluates many types of information from your credit report.

We all know that a history of paying bills late can be very detrimental to your score (generally accounts for approximately 35% of your score). But, did you know that the big three credit services (Equifax, TransUnion and Experian) base a large part of your credit scores on the “balance due” to “card limit” ratio?? This ratio can accounts for approximately 30% of your score!

My husband and I try very hard to live a “debt free” lifestyle. But, in order to get “reward points” for cash back or air miles, we usually charge everything to a credit card and then pay it off at the end of the month (this also makes it very easy for us track spending and keep our budget under control). You would think that would mean that we are using zero, or a very small percentage, of our available credit – but that it not how it works!

Here is an example of how the credit services look at this scenario: If we have a $10,000 limit on our Visa card and we spend $5,100 per month (easy to do when you have monthly business expenses in additional to personal spending) the credit companies consider it to be as if we are using 51% of your available credit… even if you pay it off at the end of the month! What???? This plan can actually lower our credit score.

Here’s the REASON – the credit services only receive information from your credit card companies once a month, so they never see the paid off balance only the outstanding balance due!

To keep our score from being affected, we have chosen to split our purchases over 2 cards (1 for business and 1 for personal) to guarantee that we never use over 30% of the available credit on any card.

I recommend that you look through the credit cards in your wallet… including all the ones that give you coupons or discounts in a department or home improvement store…. these usually have very low credit limits and this rule applies to them too!

The best advice I can give someone preparing to buy a home in the near future is review your credit report NOW and pay down every credit card to reach a balance due of 50% or less (30% is preferable!).

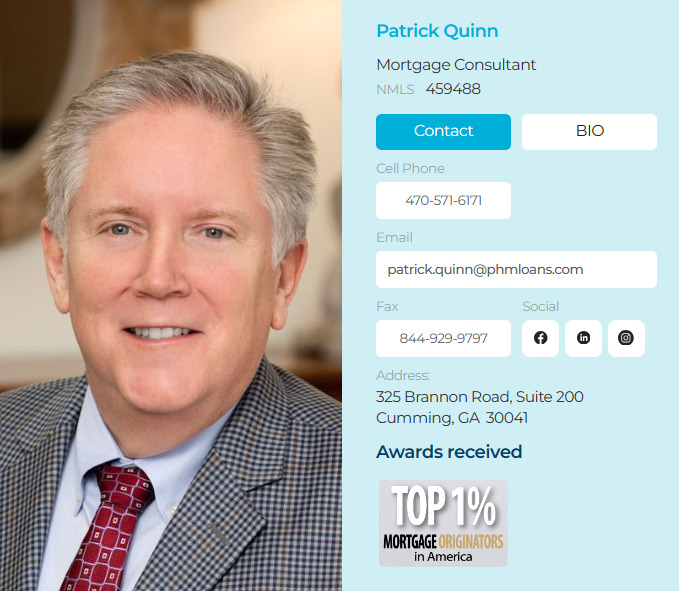

And… speak to a lender to get pre-approved.

If you are not currently working with a lender and need a referral to a local mortgage pro, give me a call and I’ll gladly provide you with a copy of my “preferred lender” list.

Please feel free to call or text me at 404-710-0204 (or drop me an email) if I can provide you with more information about this article, or if I can assist you with buying or selling your

South Forsyth County real estate.

This Cumming GA Real Estate blog is hosted by Gayle Barton of BERKSHIRE HATHAWAY HomeServices Georgia Properties.

I specialize in Real Estate sales in the following Forsyth County and North Fulton County cities: Cumming, Suwanee, Alpharetta, Milton and Johns Creek. Other north metro-Atlanta suburbs are serviced by request, so please call.

Gayle Barton Forsyth County Real Estate | Cumming GA Real Estate | Mountain Crest Homes For Sale

Gayle Barton Cumming GA Real Estate | Forsyth County Real Estate

My clients needs are my number one priority and putting them first is how I distinguish myself from other agents in my area.

My clients needs are my number one priority and putting them first is how I distinguish myself from other agents in my area.